USDT Staking & Passive Income in 2025: Latest News, Trends, and Earning Strategies

USDT Staking & Passive Income 2025: Market Insight

1. Market Background & Breaking News

As we enter the last quarter of 2025, stablecoin staking has become one of the most popular passive income strategies in the crypto world.

A major headline this month: Tether (USDT) announced plans to launch a new U.S.-regulated stablecoin, “USAT,” by the end of 2025 to comply with the new GENIUS Act financial regulations.

This could reshape how American users earn yields with stablecoins, marking a shift toward more transparent and compliant crypto income models.

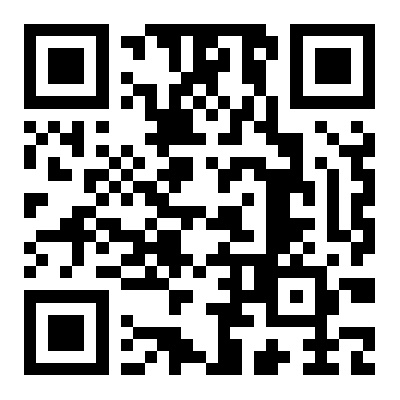

2. What Is USDT Staking (and Why It’s Different)?

Technically, USDT isn’t a Proof-of-Stake (PoS) token — it doesn’t secure a blockchain network directly.

However, “USDT staking” refers to depositing your Tether tokens on centralized exchanges (CEXs), DeFi protocols, or lending platforms to earn yield, interest, or bonuses.

It’s essentially a crypto savings or yield strategy, where your capital earns passive income through lending or liquidity provision.

3. Current Yield Rates & Top Platforms (2025 Data)

According to current market trackers:

💰 Average USDT APY: 1% – 8.8%

🚀 Promotional / DeFi pools: up to 20%+ (especially for limited lock-up offers)

🔹 Kraken “opt-in rewards” reach up to 5.5% APY

🔹 Gate.io & OKX periodically offer 10–15% annualized returns for flexible USDT deposits

The yields vary based on platform type, liquidity pool risk, and lock-up duration.

([Source: CoinLaw.io, CryptoBriefing.com])

4. Advantages of USDT Staking

✅ Stable Asset Base – USDT’s peg to USD minimizes price volatility, ensuring steady yield accumulation.

✅ Truly Passive – Your tokens work for you without active trading.

✅ Flexible Withdrawals – Many platforms allow instant redemption.

✅ Compounding Opportunity – Reinvesting earned interest can amplify long-term profits.

5. Risks You Must Consider

⚠️ Platform Risk: Exchange hacks or insolvency events can cause fund loss.

⚠️ Lock-up Periods: Some programs restrict withdrawals for weeks or months.

⚠️ Yield Compression: As more capital enters, APYs tend to decline.

⚠️ Regulatory Uncertainty: Future laws may limit or tax yield products.

⚠️ Tax Implications: Many jurisdictions classify staking rewards as taxable income.

6. How to Start Earning Passive Income with USDT

Choose a trusted platform — check audits, history, and community reputation.

Diversify your yield sources — don’t keep all USDT in one pool.

Check lock-up terms — flexibility matters for liquidity.

Track net yield — consider withdrawal and gas fees.

Monitor market conditions — exit when yields drop or risks rise.

7. The Future of Stablecoin Yields

The next evolution of passive crypto income is likely to combine AI-managed DeFi portfolios, cross-chain liquidity, and regulation-friendly stablecoins like USAT.

As competition grows and regulations tighten, transparency and sustainable yield models will define the winners in the stablecoin staking sector.

download

download download

download website

website